This blog is part three of a three-part series discussing Start-up Scandals, Board of Directors Criteria, and Governance Measures for start-ups to reduce risk and gain the trust of investors and boards. See Part1: Startups, Scandals and Fraud. Oh My! (The scandals) — Part2: Startups Scandals and Fraud. Oh My! (Board of Directors) – Part3: Startups, Scandals and Fraud. Oh My! (Governance Mechanisms)

In parts one of this series, we talked first about CEO start-up scandals, highlighting FTX, Theranos, Uber, Mozido, and Bouxtie. In part two, we shared the importance of having a solid board for company oversight. Today, we will address company integrity through board structure and governance planning for start-ups to create transparency and build investor trust.

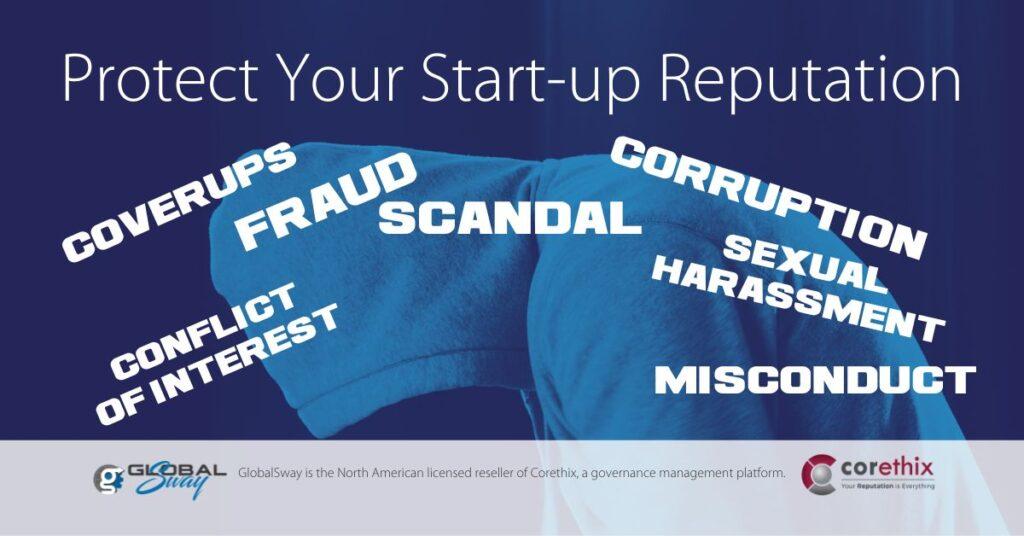

Build Integrity by Avoiding Scandals and Fraud

The Oxford online dictionary provides the meaning of the word integrity as we imagine investors wish for entrepreneurs to aspire.

in·teg·ri·ty /inˈteɡrədē/ (noun)

the quality of being honest and having strong moral principles; moral uprightness.

“He/she/they are known as persons of integrity.”

VCs and Boards of Directors who prioritize governance mechanisms to control and report corruption, fraud, misconduct and risk behaviours are more apt to avoid loss. When poorly managed or no governance is in place, boards are left responsible for dealing with the scandal aftermath. Part 1 of this series offers only a few of many recent examples! (link)

People state that it’s almost impossible to detect forgery, falsified reports, or hidden scandalous behaviour, but there is one thing we know about scandals. Once investigated, in most cases, some people either knew or suspected the truth but had no actionable means of reporting it. Often, those employees feared losing their jobs or felt forced to participate in the activities themselves.

Mechanisms of Good Governance to avoid scandal

The lack of transparency in reporting both good and bad news is a big red flag for seasoned investors. To entrepreneurs anxious to reach success quickly, it feels weighty or cumbersome but dealing with the fallout, public relations nightmares, and significant investment losses destroys start-up potential and damages reputations.

Had the investors or Boards of FTX, Theranos, Uber, Mozido and Bouxtie insisted on protective mechanisms, such as a solid Board Structure and the right tools, perhaps those investments would not have suffered such significant losses. Going beyond the bare minimum fiduciary reporting is necessary.

Itemized below are some considerations for Board Structure and Governance Mechanisms.

Board Structure & Reporting

- Go beyond typical advisory practices and standard corporate by-laws that focus on only reporting financials. Include incident tracking, declarations, and speak-up capabilities, so employees at risk can inform long before risky activities get out of hand.

- Structure Board reporting to encompass:

- transparency and accountability;

- equity, diversity and inclusion;

- safety, privacy and security;

- effectiveness and efficiency,

- industry and securities compliance;

- ethics, integrity, human rights, and social cohesion.

- Clearly define governance roles & responsibilities for tracking, reporting, and managing risk. (For start-ups, we recommend Collective Governance (link) to keep costs low. The design includes forum neutrality and consensus-based decision-making, designed for pre and post-first-round timeframes)

- Understand early on what it means to protect business value for the start-up. For instance, technology start-ups must consider how to create, protect and deliver digital business value (CPD) as described by the DVMS institute to avoid significant cyber risk for technology start-ups.

Governance Mechanisms

- Centralize policy management, controls, and file management for policies, procedures, training, and transparency.

- Ensure all employees, including the executive, attest they’ve read the policies and will abide by understanding clearly defined consequences.

- Provide mechanisms for employees to anonymously report, provide evidence, and champion the practice of legitimate leadership.

- Where reports of complex issues of legality, bullying, harassment, or fraud occur, insist on well-trained 3rd-Party investigations to avoid scandalous behaviours from being uncovered first in the news.

Start-ups can learn to implement effective mechanisms before growth impedes risk management or impropriety gets out of control.

Disclaimer: The Board Structure and Governance Risk Management considerations in this series are not to be construed as legal, CPA, or other Professional Services advice. GlobalSway recommends that you consult with the proper professional services, such as legal, human resources, financial, and consultants, as part of a collaborative ecosystem in governance design.

_______________

GlobalSway works with your Board, Executives, and Professional Services providers to facilitate excellent governance models for start-ups and existing companies. We aim to ensure you have the mechanisms in place, so governance is a living, dynamic process that reduces risk and protects the business. Your reputation is everything!

Sign up for a free trial of the Corethix Platform, an affordable platform for managing company reputation and integrity. You can also book a Demo to see how Corethix can help your organization.