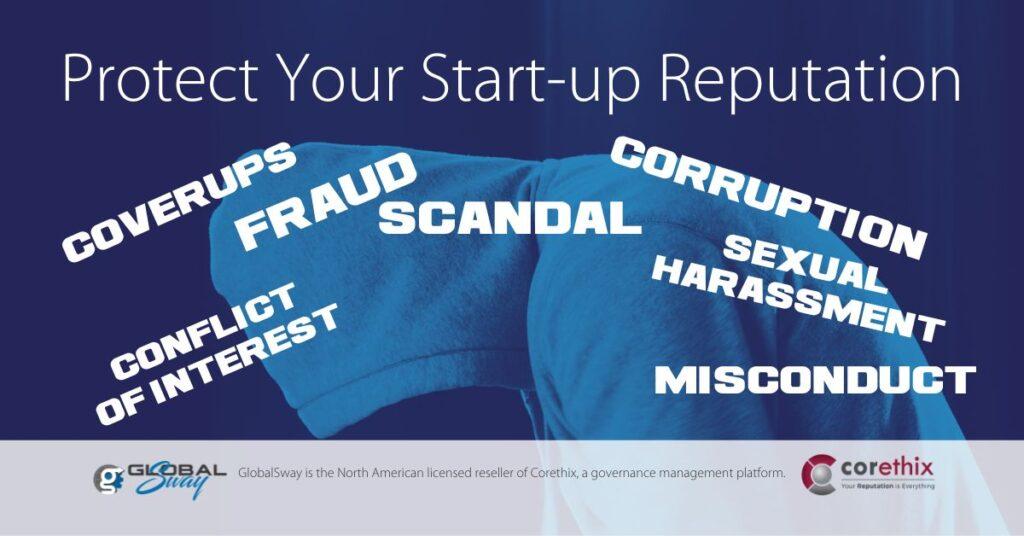

This blog is part three of a three-part series discussing Start-up Scandals, Board of Directors Criteria, and Governance Measures for start-ups to reduce risk and gain the trust of investors and boards. See Part1: Startups, Scandals and Fraud. Oh My! (The scandals) — Part2: Startups Scandals and Fraud. Oh My! (Board of Directors) – Part3: Startups, Scandals and Fraud. Oh My! (Governance Mechanisms)

Did you know the median time for an innovative company to move from seed capital to IPO is 5.7 years? (Statistica.com) In that period, several funding rounds will have occurred, and investors know it takes time to see a return on their investment, so they tend to push hard on revenue focus and less on governance and risk management. The risk they run is improperly setting up governance to avoid scandals and fraud.

The Entrepreneurial Challenges

Most entrepreneurs struggle with reporting to a board, even as investors beg for more and more information. Without some background in risk management, it feels cumbersome and the last place they want to spend their limited time.

Entrepreneurs are under intense pressure to live up to the hype they’re generating for their innovation, which can lead people to act unusually. They need quick wins and tend to perceive future results as less valuable than present activities, thus failing to plan well for the funds received. With others, receiving vast sums of dollars gives CEOs an increased sense of power and elicits a form of temporal discounting that hinders their long-term planning for those funds.

“We are a start-up; we don’t want the weight of corporate bureaucracy to slow us down! Being a start-up is all about risks!”

Start-up Advisory and Corporate Boards of Directors

They are right, to a point. A start-up that fails to calculate the risks assiciated with funding rounds and wrap some controls around those funds are the very start-ups that get themselves in trouble. These Start-ups scandals and fraud articles wish to address the difference between risky, and calculated risks.

The Center for Financial Inclusion provides information on how to form, manage, and structure a board for fast-growing, innovative start-ups to protect against poor governance. We also have a few suggestions.

The Board of Directors’ membership criteria is essential to minimizing entrepreneurial risks and dodgy attitudes. Imagine if entrepreneurs equally ignored the need for collaboration tools, file sharing, document management, code repositories, and software security! Bedlam!

Influential industry celebrities may be critical to building a start-up board, but they are only one criterion. Here are suggestions start-ups might consider in selecting the Board of Directors to support company integrity when seeking the first round of funding:

- A Board Advisory/Governance membership with diverse factors such as age, race, gender, educational background and professional qualifications (trying to avoid the CEO/Entrepreneur buddies trap)

- A Board member with legal skills in navigating securities compliance sets the organization on the right path (even long before the run for IPO.)

- A Board member with experience in risk management and audit who can guide the start-up in acceptable, transparent reporting

- A Board member representing Investors’ interests

- A Board member representing the ideal customers with a background in customer experience and social cohesion

- Technical mechanisms in place beyond standard financial reporting, such as policy management, incident reporting, declarations, and speak-up capabilities (as an investor, I would insist on these)

A start-up rarely has funds to hire for governance integrity, but they can begin laying the foundation for it through Board advisory before first-round funding. First-round funding, however, must include a salaried role for company governance, even if there is no public offering in place.

But don’t confuse governance with command and control; instead, it provides the mechanisms for building trust between the start-up Employees, the Board, the Investors, and the Customers.

Come back next week for Part 3: Start-ups, Scandals, and Fraud. Oh My! Where we will cover governance mechanisms within a start-up in greater detail.

Disclaimer: The Board Structure and Governance Risk Management considerations in this series are not to be construed as legal, CPA, or other Professional Services advice. GlobalSway recommends that you consult with the proper professional services, such as legal, human resources, financial, and consultants, as part of a collaborative ecosystem in governance design.

_______________

GlobalSway works with your Board, Executives, and Professional Service providers to facilitate excellent governance models for start-ups and existing companies. We aim to ensure you have the mechanisms in place, so governance is a living, dynamic process that reduces risk and protects the business.

Sign up for a free trial of the Corethix Platform, or book a Demo to see how Corethix can help your organization. Your reputation is everything!